Privileges

Get your Mauritian residence permit

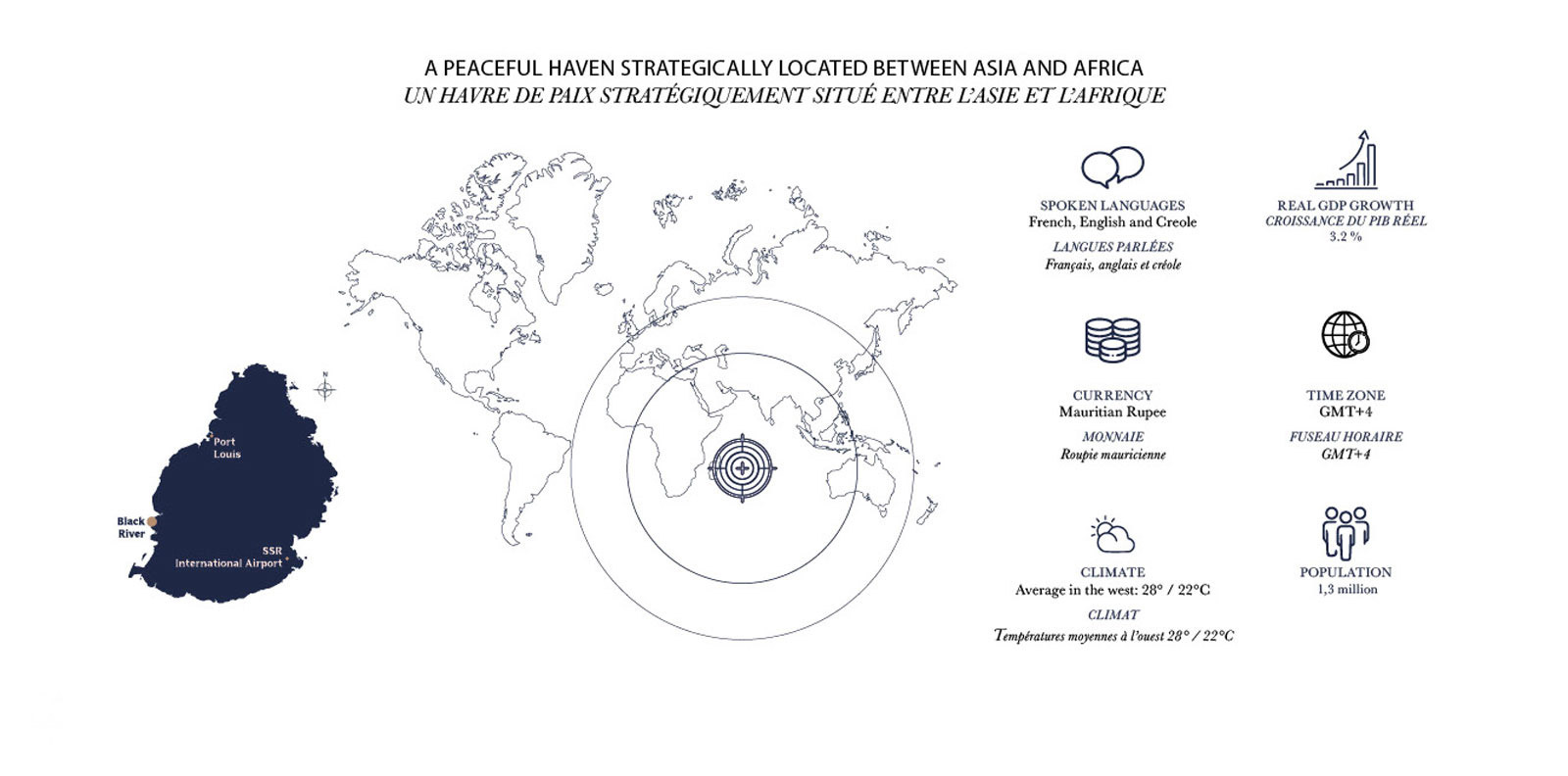

Since Independence, Mauritius has emerged as a strong and stable democracy, with an independent judiciary and an enviable reputation for a peaceful way of life.

A great advantage with Marina Bay Boutique Residences is that, when foreign nationals buy one of the apartments with a minimum investment of USD 375,000, they and their immediate family are eligible for a Mauritian permanent residence permit under the framework of a G+2 development.

Ideally located between Asia and Africa, it is perfect for business people and its tax regime is well appreciated by investors. Holidaymakers are seduced by the all-year-round warmth on the coast, the sandy beaches and the beautiful countryside.

Tax Advantages

- Corporate and individual flat tax rate of 15%

- DTAs (Double Taxation Agreements) in place with 44 countries, including the United Kingdom, France, Belgium, Germany, Italy, Luxembourg, Madagascar, Malaysia, South Africa, Sri Lanka, Swaziland, Sweden and more

- Only 15% tax on rental income

- No capital gains tax

- No housing or property tax

- No inheritance tax